Ca Sdi Following Taxes Are Paid to Which Government Agency

That is California state disability insurance. A California employee is eligible for PFL if he needs to take time off to care for a sick family member or new child.

Total And Partial Unemployment Tpu 460 55

This could occur if a person was receiving UI benefits and then became disabled.

. Claimant worked for two or more employers subject to withholding California SDI. It is a mandatory tax. When the sum of two or more employers SDI withholding on W-2s entered in TTfederal exceeds 939 then TTCalif will compute the credit.

These taxes are also called SDI contributions. Alaska Unemployment Compensation Fund. California does not tax.

Deductions for California SDI were made from calendar year wages. SDI taxes are paid on income of up to 145600 a year which means you dont pay SDI tax on anything you earn above that amount. Employees are required to pay into the SDI program via paycheck.

The UI rate schedule and amount of taxable wages are determined annually. Elected officials elected officials are not considered employees of the government entity. SSI benefits in California are paid by the state government.

Mandatory payments made to the following state benefit funds are deductible as state income taxes on Schedule A Form 1040 line 5. These benefits then get added into the rest of. If youre using a 1040EZ enter this on line 3.

When entering your w-2 put your CA SDI amount in box 14 instead of box 19 if it is in 19 so that it will be. The following employees of public entities are excluded from UI and SDI coverage. All family employees wages are reportable as California Personal Income Tax PIT wages and subject to PIT withholding.

How to get credit for excess ca sdi. Enter the amount shown on line 19. Using SDI Online to file or manage your claim will.

Another way of thinking about this is that the most anyone might have to pay into SDI for 2022 is 160160. To contact a representative or to use the State Employee Automated Phone Service. Reduce your claim processing time.

When SDI benefits are received as a substitute for UI benefits the SDI is taxable by the federal. Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. Submit your Disability Insurance DI and Paid Family Leave PFL claims and forms easily online.

SDI benefits are usually not subject to federal taxes unless the Internal Revenue Service considers the payments unemployment compensation or the payments were PFL benefits. California State Government Employees. If its a 1040A the amount has to go on line 13.

The benefits range from 1500 to 16000 per year. SDI Online is fast convenient and secure. However the following family employees wages.

SSI payments are made on a sliding scale so the lower the income the. New employers pay 34 percent 034 for a period of. UI is paid by the employer.

SDI benefits are taxable only if paid as a substitute for unemployment insurance UI benefits. California does not tax social security benefits and equivalent tier 1 railroad retirement benefits. SDI Contribution Rate and Wage Ceiling Effective January 1 2022 the SDI worker contribution rate will be 11 percent of an employees annual gross taxable wages up to 146600.

Provides informational resources about programs and services available to people with disabilities. This could occur if a person was receiving UI benefits and then became disabled. California Department of Fair Employment and Housing.

California And New Jersey Hsa Tax Return Special Considerations

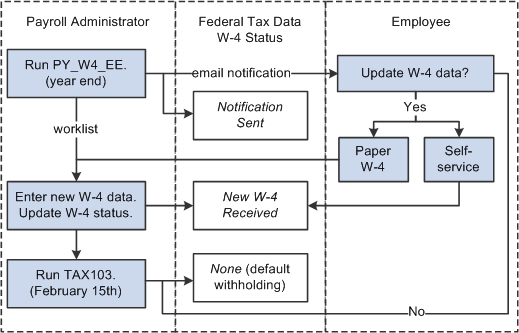

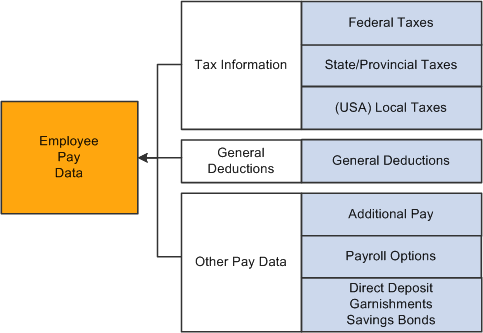

Peoplesoft Payroll For North America 9 1 Peoplebook

Comments

Post a Comment